Beyond Crypto: How Blockchain Became Core Infrastructure for the Global Economy

From Speculation to Infrastructure

Blockchain has moved decisively beyond its early association with speculative cryptocurrency trading to become a structural component of the global digital economy. While Bitcoin and Ethereum were the original catalysts that brought distributed ledger technology into public view, it is now the underlying blockchain architecture that is being embedded into mission-critical systems across finance, supply chains, healthcare, government, and digital services. For decision-makers in North America, Europe, Asia, Africa, and South America, blockchain is no longer a fringe innovation; it is an operational reality that shapes how data is trusted, how assets are traded, and how institutions demonstrate accountability.

For upbizinfo.com, this shift is central to the way global business, finance, and technology trends are interpreted for a professional audience. Executives, founders, investors, and policymakers who follow upbizinfo.com are increasingly focused on how blockchain underpins new business models in banking, employment, markets, and sustainable growth, rather than on short-term price movements of digital tokens. In this environment, experience, expertise, authoritativeness, and trustworthiness are not abstract attributes; they are competitive necessities, and blockchain is one of the core tools organizations deploy to prove that their data, transactions, and disclosures can be relied upon.

Trust Architecture in a Trustless World

The defining promise of blockchain remains its ability to create a tamper-evident, time-stamped record of transactions without relying on a single central authority. Instead of placing absolute trust in a bank, registry, or platform, verification is distributed across a network of participants that collectively validate and store the ledger. This model dramatically reduces the risk of unilateral manipulation, improves resilience against outages or cyberattacks, and provides a clear cryptographic audit trail that can be examined by regulators, auditors, partners, and, where appropriate, customers.

Global enterprises such as IBM, Microsoft, and Oracle have spent the past several years integrating permissioned blockchain frameworks into their enterprise stacks to support traceability, digital identity, and automated contracts. Public-sector bodies in Europe, Asia, and the Americas are experimenting with similar models to secure registries, licenses, and citizen records. Rather than eliminating institutions, blockchain is redefining their role: instead of being sole gatekeepers of trust, they become orchestrators of shared, verifiable data environments. This transition is particularly important for readers of upbizinfo.com/technology.html, where the intersection of infrastructure, software, and governance is a recurring theme.

Financial Services, Smart Contracts, and Digital Identity

Financial services remain at the forefront of blockchain adoption, but the emphasis in 2026 is less on speculative decentralized finance experiments and more on regulated, production-grade systems that improve efficiency and compliance. Smart contracts-self-executing code deployed on blockchain networks-are now used by major institutions to automate syndicated loans, trade finance, insurance payouts, and cross-border settlements. Organizations such as JP Morgan Chase, Goldman Sachs, Visa, and BNP Paribas have built or joined blockchain-based networks that settle transactions in minutes rather than days, while reducing reconciliation costs and operational risk.

Digital identity has become an equally important pillar. Financial institutions in the United States, the United Kingdom, the European Union, Singapore, and Australia are increasingly turning to blockchain-based identity frameworks that allow individuals and businesses to control reusable, cryptographically verifiable credentials. This supports stringent Know Your Customer and Anti-Money Laundering requirements while reducing onboarding friction and fraud. To understand how these developments align with broader banking modernization, readers can explore secure banking transformation in more depth.

Professional services firms such as Deloitte, PwC, KPMG, and Ernst & Young (EY) have documented how decentralized finance concepts are being absorbed into mainstream capital markets and retail banking. Hybrid architectures now combine permissioned blockchains, central bank digital currency pilots, and tokenized deposits with traditional risk management and regulatory oversight. For business leaders, the strategic question is no longer whether blockchain will affect financial operations, but how quickly existing infrastructure can be re-engineered to capture the efficiency, transparency, and compliance advantages it offers.

For background on how these trends intersect with crypto-native innovation and regulation, readers can review insights on digital assets and regulation.

Transparent and Resilient Supply Chains

In global supply chains, blockchain has evolved from pilot projects into operational platforms that support end-to-end visibility. Complex, multi-jurisdictional networks-spanning manufacturers in East Asia, logistics hubs in Europe, retailers in North America, and raw material suppliers in Africa or South America-depend on a single, trusted version of events that all participants can reference. Blockchain provides that shared ledger, capturing provenance, certifications, shipping milestones, and quality checks in a way that cannot be silently altered after the fact.

Companies such as Maersk, Nestlé, and Walmart have implemented blockchain-based traceability to verify product origins, combat counterfeiting, and respond quickly to safety incidents. IBM Food Trust, for example, enables retailers and regulators to trace food products from farm to shelf in seconds, reducing waste and enhancing consumer confidence. International organizations and standards bodies, including the World Trade Organization and the International Organization for Standardization, have recognized blockchain's role in harmonizing data across borders and industries.

For sustainability-focused readers of upbizinfo.com/sustainable.html, the supply chain use case is particularly relevant. Blockchain-based ledgers now record environmental, social, and governance attributes such as carbon intensity, labor standards, and recycling practices. This allows brands, regulators, and investors to verify that products marketed as sustainable, fair-trade, or low-carbon are backed by traceable evidence rather than marketing rhetoric, a critical requirement as climate disclosure rules tighten in the European Union, the United States, and other jurisdictions.

Healthcare Data Integrity and Patient-Centric Systems

Healthcare systems in the United States, Europe, and Asia-Pacific have long struggled with fragmented records, inconsistent data quality, and weak interoperability. Blockchain is increasingly being used as a backbone for verifiable healthcare data, ensuring that clinical information, prescriptions, and consent records are accurate, tamper-evident, and accessible to authorized parties across institutional boundaries. Solutions from companies such as MediLedger, Change Healthcare, and BurstIQ demonstrate how distributed ledgers can synchronize data between hospitals, insurers, pharmacies, and research organizations without exposing sensitive patient details.

By anchoring hashes of medical records or transactions on a blockchain, organizations can prove that data has not been altered, while actual content remains encrypted and stored in compliant repositories. This is particularly important in clinical trials and pharmaceutical supply chains, where data integrity and provenance directly affect patient safety and regulatory approval. The World Health Organization and regional regulators have taken an interest in these models as part of broader digital health strategies.

For patients, blockchain-enabled identity and consent management systems allow them to grant and revoke access to their health data in a granular way, supporting telemedicine, cross-border care, and personalized medicine. As healthtech converges with AI, genomics, and connected devices, readers following technology and health innovation on upbizinfo.com/technology.html will see blockchain increasingly presented not as a consumer-facing feature, but as the invisible trust layer that keeps complex data ecosystems reliable and auditable.

Government, Public Services, and Digital Governance

Governments across continents are now treating blockchain as a strategic component of digital statecraft. Estonia's long-standing e-government infrastructure, secured by blockchain-inspired technologies, continues to serve as a reference model for digital identity, e-residency, and secure registries. The United Arab Emirates has advanced its nationwide blockchain strategy with projects in land registration, customs, and judicial records, aiming to reduce paperwork, fraud, and processing times. Municipal and national authorities in countries such as Singapore, South Korea, and Switzerland are piloting blockchain-based voting, welfare distribution, and procurement systems.

These initiatives are closely monitored by global institutions such as the OECD and the World Bank, which analyze how digital public infrastructure can improve transparency and reduce corruption. Immutable records of budget allocations, contract awards, and benefit payments allow citizens, auditors, and civil society organizations to scrutinize public spending more effectively. For readers of upbizinfo.com/economy.html, this is not simply a technology story; it is a structural shift in how economic governance is executed and monitored.

In parallel, smart city initiatives in hubs such as Singapore, Dubai, Helsinki, and Seoul are using blockchain to manage digital identities, mobility services, and data-sharing agreements between public and private actors. By giving residents greater control over their data and ensuring that access is logged immutably, these cities are attempting to balance innovation with privacy, a tension that will define urban policy in the coming decade.

Tokenization of Real Assets and New Investment Models

One of the most significant developments between 2023 and 2026 has been the institutional embrace of tokenization-the representation of real-world assets as digital tokens on regulated blockchain networks. Real estate, private equity, infrastructure projects, fine art, and even revenue streams from intellectual property are now being fractionalized and traded on platforms operated by firms such as Securitize, Polymath, and Tokeny Solutions. Major market operators including NASDAQ, London Stock Exchange Group (LSEG) are building or partnering with tokenization platforms to support issuance and secondary trading of digital securities.

For investors, tokenization offers lower minimum investment thresholds, faster settlement, and improved transparency over ownership and corporate actions. For issuers, it reduces administrative overhead and opens access to a broader, often global, investor base while remaining within regulatory frameworks defined by authorities such as the U.S. Securities and Exchange Commission and the European Securities and Markets Authority. This is particularly relevant for readers of upbizinfo.com/investment.html, where the democratization of access to high-quality assets is a recurring theme.

Tokenized money-ranging from bank-issued tokenized deposits to regulated stablecoins and emerging central bank digital currencies-is also becoming integral to these markets. The Bank for International Settlements and leading central banks in regions such as the Eurozone, China, and the Nordics are exploring how wholesale and retail CBDCs can interoperate with tokenized securities platforms to enable atomic settlement, reducing counterparty risk and freeing up capital across borders.

Employment, Skills, and the Blockchain-Enabled Workforce

The global labor market has experienced profound shifts, driven by remote work, platform-based employment, and automation. Blockchain is now quietly embedded in many of the systems that underpin this new world of work. Decentralized talent platforms such as Braintrust and LaborX leverage blockchain to record work histories, manage smart-contract-based engagements, and execute automatic, transparent payments in fiat or digital currencies. These models reduce reliance on centralized marketplaces that charge high commissions or control user reputations.

Human resources departments in multinational firms are experimenting with blockchain-based credential verification, enabling rapid, reliable validation of degrees, certifications, and prior employment. Universities such as MIT, Harvard, and University College London have issued verifiable digital diplomas anchored to blockchains, which can be checked instantly by employers worldwide. This reduces the risk of credential fraud and shortens hiring cycles, a topic that resonates with readers of upbizinfo.com/jobs.html and upbizinfo.com/employment.html.

For workers in emerging markets, particularly in Africa, Southeast Asia, and Latin America, blockchain-based identity and payment systems are enabling participation in global service markets without traditional banking infrastructure. Combined with mobile devices and digital wallets, these tools support financial inclusion and cross-border income generation, themes that are increasingly central to coverage on upbizinfo.com/world.html.

Marketing, Consumer Trust, and Data Ethics

Marketing and customer engagement are undergoing a structural reset as regulators and consumers demand more control over personal data and more transparency in advertising practices. Blockchain is emerging as a mechanism to verify ad impressions, track campaign performance, and ensure that creators, influencers, and publishers are compensated fairly. Corporations such as Unilever, Coca-Cola, and Reckitt have participated in blockchain-based pilots that map digital ad supply chains end-to-end, reducing fraud and enabling more accurate attribution.

Decentralized advertising ecosystems, exemplified by Brave Browser and AdEx Network, allow users to choose what data they share and to be rewarded directly for their attention. This aligns with regulatory frameworks such as the EU's General Data Protection Regulation and California's Consumer Privacy Act, which require explicit consent and accountability for data usage. For marketing professionals, this means that blockchain is not a consumer-facing buzzword but a back-end assurance mechanism that supports ethical, measurable engagement. Readers can explore this evolution further through analysis at upbizinfo.com/marketing.html.

In parallel, luxury and retail brands, including Louis Vuitton, Cartier, and Prada, are using blockchain to authenticate products and power digital loyalty experiences. Customers can verify provenance via QR codes or NFC tags linked to blockchain records, while also receiving tokenized rewards or digital collectibles. This fusion of physical and digital ownership is reshaping brand strategies and is particularly relevant to lifestyle and consumer behavior coverage on upbizinfo.com/lifestyle.html.

Sustainability, Climate Accountability, and Energy Markets

As climate regulation tightens in the European Union, the United States, the United Kingdom, and other regions, organizations are under pressure to provide auditable evidence of their environmental performance. Blockchain is emerging as a preferred infrastructure for carbon markets, renewable energy certificates, and ESG reporting. Initiatives such as Energy Web Foundation, Verra, and KlimaDAO use blockchain to register, track, and retire carbon credits, making it harder for companies to double-count offsets or engage in superficial "greenwashing."

Energy utilities and grid operators in Europe, Australia, and North America, including E.ON and Engie, are piloting blockchain-based platforms that support peer-to-peer energy trading, decentralized microgrids, and automated settlement of renewable energy contracts. By recording generation and consumption data from smart meters and IoT devices on a distributed ledger, these systems can verify that "green" tariffs are backed by actual renewable production. The International Energy Agency and other bodies are studying how these models can scale while preserving grid stability.

For the audience of upbizinfo.com/sustainable.html, the significance is clear: blockchain is becoming a foundational technology for credible climate disclosures and sustainable finance. Institutional investors increasingly expect portfolio companies to provide machine-readable, verifiable ESG data, and blockchain-based registries offer a path to meeting that expectation in a standardized, cross-border manner.

Security, Compliance, and the Regulatory Perimeter

As organizations digitize their operations, cybersecurity and regulatory compliance have become board-level concerns. Blockchain contributes to security not by eliminating risk, but by changing its profile. Distributed storage and consensus reduce single points of failure, while cryptographic proofs provide strong guarantees that data has not been surreptitiously altered. Firms such as Guardtime, Certik, and AnChain.AI are building blockchain-based solutions that monitor transactions, detect anomalies, and secure critical infrastructure.

Regulators have responded by clarifying the treatment of blockchain systems and digital assets within existing legal frameworks. Jurisdictions such as Singapore, Switzerland, and Japan have developed licensing regimes for blockchain service providers and exchanges, while the Financial Stability Board and the International Monetary Fund assess systemic implications. Automated "regtech" solutions, often built on or integrated with blockchains, are helping institutions implement real-time reporting, sanctions screening, and compliance checks embedded directly into transaction flows.

For readers of upbizinfo.com/business.html, this convergence of technology, law, and risk management underscores why blockchain expertise is moving from innovation labs into core enterprise architecture and governance functions. The organizations that succeed are those that treat blockchain as a long-term compliance and transparency asset, not a short-lived experiment.

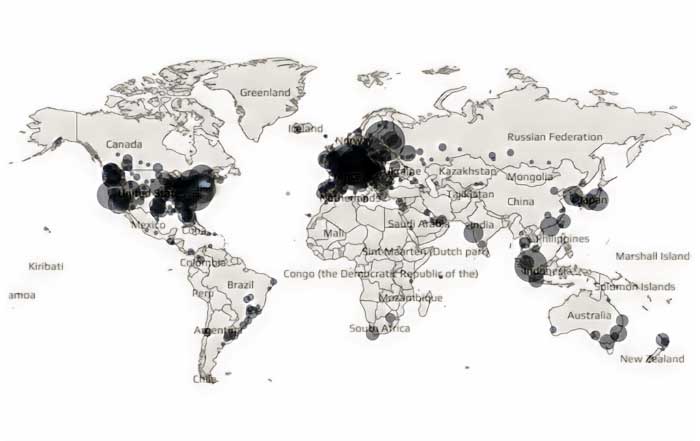

How upbizinfo.com Interprets the Blockchain Decade

By 2026, blockchain has matured from a speculative frontier to a multi-layered infrastructure that supports banking, markets, employment, logistics, sustainability, and digital governance. It is woven into the workflows of corporations in the United States, the United Kingdom, Germany, Canada, Australia, France, Italy, Spain, the Netherlands, Switzerland, China, Sweden, Norway, Singapore, Denmark, South Korea, Japan, Thailand, Finland, South Africa, Brazil, Malaysia, and New Zealand, as well as regional blocs across Europe, Asia, Africa, and the Americas. The technology's impact is not confined to one geography, sector, or asset class; it is systemic.

For upbizinfo.com, the responsibility is to translate this systemic shift into clear, actionable insight for business leaders, founders, investors, and professionals who must make decisions in real time. Coverage across AI and automation, global markets, employment and jobs, investment strategy, and world economic trends is increasingly interconnected, because blockchain itself sits at the junction of technology, finance, regulation, and societal change.

As enterprises and governments continue to build on blockchain, the central narrative is shifting from experimentation to execution. The organizations that thrive will be those that combine deep domain expertise with a rigorous understanding of how decentralized trust frameworks can enhance resilience, transparency, and competitiveness. In that context, blockchain is not merely a technology trend to watch; it is a long-term structural force that upbizinfo.com will continue to analyze as it reshapes the architecture of the global economy.