SaaS: How Subscription Software Powers the Global Business Engine

SaaS as the Operating System of Modern Business

Software as a Service (SaaS) has moved from being a disruptive alternative to traditional software to becoming the de facto operating layer of modern business. For decision-makers across North America, Europe, Asia-Pacific, Africa, and Latin America, SaaS is no longer simply a technical choice; it is a strategic foundation that shapes how organizations compete, innovate, and scale in a digital-first economy.

SaaS refers to applications delivered over the internet and hosted in the cloud, replacing the legacy model of purchasing perpetual licenses, installing software on local servers, and maintaining complex infrastructure. Instead, organizations subscribe to services, typically on monthly or annual terms, paying for the capabilities they actually use. This model has unlocked access to enterprise-grade tools for startups just as readily as for multinationals.

For the audience of upbizinfo.com, which closely follows developments in AI, banking, business, crypto, the economy, employment, founders, markets, sustainability, and technology, SaaS is now the connective tissue that links these domains. It underpins digital banks, orchestrates remote work, powers AI-driven analytics, and enables founders to build global companies from day one. Understanding SaaS in 2026 is therefore essential not only to grasp technology trends but also to interpret shifts in capital markets, labor markets, and global trade. Readers exploring broader business dynamics can place SaaS within this context by engaging with insights on business transformation and global economic change.

Core Principles and Architecture of SaaS in 2026

At its heart, SaaS remains defined by cloud-native delivery, multi-tenancy, and continuous updates, yet the sophistication of the underlying architecture has grown significantly. Most leading SaaS providers now operate on hyperscale cloud platforms such as Amazon Web Services, Microsoft Azure, and Google Cloud, which provide elastic compute and storage resources across multiple regions. This enables them to offer high availability, low-latency access, and robust disaster recovery to customers from the United States and Canada to the United Kingdom, Germany, France, the Netherlands, Singapore, Japan, and beyond.

Multi-tenancy-where multiple customers share a common infrastructure while maintaining strict data separation-remains the economic engine of SaaS, allowing providers to spread infrastructure and development costs across thousands or millions of users. At the same time, advances in containerization and microservices have allowed vendors to offer more granular configuration and modular features, giving enterprises bank-grade security and compliance while retaining the cost efficiencies of shared infrastructure. Readers interested in how these architectural shifts intersect with broader technology innovation can explore related coverage on digital infrastructure and AI.

Automatic updates have evolved into continuous delivery pipelines. Instead of periodic version upgrades, modern SaaS platforms ship incremental improvements weekly or even daily, often using feature flags and A/B testing to roll out capabilities to targeted user segments. This ensures that a startup in Melbourne or a bank in Zurich runs on the latest security patches and functionality without scheduling downtime or coordinating large-scale IT change programs.

As a result, SaaS is no longer perceived primarily as a cost-saving alternative to on-premise software. In 2026, it is recognized as the most reliable way to keep core systems secure, compliant, and aligned with fast-moving regulatory and market requirements-from European data protection rules to evolving financial regulations in Asia and North America.

SaaS and Business Efficiency: From Tools to Intelligent Systems

Business efficiency in the mid-2020s is increasingly defined by the ability to automate routine work, orchestrate complex workflows across departments and regions, and derive insight from data in real time. SaaS has evolved from a collection of discrete tools into integrated, AI-augmented systems that support this ambition.

Cloud-based collaboration platforms such as Microsoft 365, Google Workspace, Slack, and Zoom have become standard infrastructure for organizations of all sizes, enabling distributed teams in Toronto, Madrid, Stockholm, and Bangkok to operate as if they were co-located. Project and work management platforms like Asana, Monday.com, and ClickUp have matured into orchestration layers that align objectives, timelines, and responsibilities across entire organizations. Learn more about how these platforms reshape work and employment patterns in the analysis of employment and jobs trends.

The most significant shift since 2023 has been the deep integration of artificial intelligence into SaaS products. AI copilots, powered by large language models and domain-specific machine learning, are now embedded across CRM, ERP, HR, finance, and marketing suites. Solutions from Salesforce, Microsoft, Adobe, and HubSpot use AI to summarize customer interactions, generate content, recommend next actions, and forecast revenue. Enterprise-grade generative AI infrastructure from organizations such as OpenAI, Google DeepMind, and Anthropic has been productized into APIs and SaaS layers, enabling businesses to integrate natural language interfaces and predictive capabilities without building foundational models themselves. Those seeking deeper context on this AI-SaaS convergence can examine coverage of AI in business operations.

In this environment, efficiency is no longer simply about reducing headcount or cutting IT costs; it is about augmenting human expertise. Executives increasingly measure SaaS value in terms of decision velocity, customer responsiveness, and the ability to experiment rapidly with new offerings.

SaaS as a Pillar of the Global Economy

The global SaaS market has become a central driver of digital GDP. In the United States, United Kingdom, Germany, France, Canada, Australia, and the Nordic countries, SaaS revenues represent a growing share of the technology sector, with many of the largest publicly listed software companies now operating predominantly or entirely on subscription models. In Asia, hubs such as Singapore, Seoul, Tokyo, and Bangalore have emerged as critical centers for SaaS innovation, particularly in fintech, logistics, and education.

SaaS has also played a vital role in narrowing the digital divide between developed and emerging markets. In countries such as Brazil, South Africa, Malaysia, Thailand, and parts of Eastern Europe and Africa, small and medium-sized enterprises are leveraging cloud-based accounting, e-commerce, and HR systems to access global markets without investing in heavy IT infrastructure. Platforms like Shopify, Xero, and Zoho enable a boutique retailer or a manufacturer to serve customers worldwide with the same digital sophistication as larger competitors. For readers tracking how such trends reshape global trade and cross-border entrepreneurship, insights on world business dynamics provide useful context.

The impact is visible in labor markets as well. SaaS companies themselves create high-skilled jobs in engineering, product management, sales, and customer success, but they also unlock secondary employment in consulting, implementation, digital marketing, and data analytics. Global freelancing and remote work platforms, many of which are SaaS-based, have further expanded opportunities for professionals in regions historically underrepresented in the technology economy.

Financial and Strategic Advantages of the SaaS Model

From a financial perspective, SaaS continues to be attractive for both operators and customers. For businesses adopting SaaS, the shift from capital expenditure to operating expenditure simplifies budgeting, reduces upfront risk, and aligns costs with actual usage. Instead of committing to large, multi-year license purchases, companies in New York, London, Milan, Zurich, or Singapore can start small, scale up as their teams and customer bases grow, or downgrade if market conditions tighten.

This flexibility proved especially valuable during periods of economic volatility and rising interest rates, when preserving cash and maintaining agility became board-level priorities. SaaS contracts with usage-based pricing and modular feature tiers allow CFOs to optimize spend in near real time, rather than being locked into rigid license agreements. The ability to integrate SaaS tools with modern banking and treasury platforms has also improved cash visibility and risk management; those interested in this intersection can explore how cloud-driven innovation is transforming banking and financial services.

For investors, SaaS remains one of the most compelling models in technology. Recurring revenue, high gross margins, and strong net revenue retention create predictable cash flows and support premium valuation multiples. Venture capital and private equity firms continue to back SaaS startups in cybersecurity, vertical industry solutions, and AI-native platforms, while public markets reward companies that demonstrate disciplined growth, efficient customer acquisition, and durable retention. Readers examining capital allocation strategies can connect this trend to broader investment themes in technology and markets.

At the strategic level, SaaS adoption is increasingly tied to competitiveness. Firms that standardize on cloud-based, integrated platforms can move faster, launch new products more quickly, and respond to regulatory and customer demands with greater precision than those constrained by legacy systems. In many industries, the question is no longer whether to adopt SaaS, but how aggressively to consolidate and rationalize overlapping tools into coherent, secure, and data-rich platforms.

Transforming Core Business Functions Across Industries

Customer Relationship Management and Revenue Operations

Customer-facing functions have been at the forefront of the SaaS revolution. Customer Relationship Management (CRM) platforms from Salesforce, HubSpot, Microsoft Dynamics 365, and others now serve as the system of record for sales, marketing, and service teams across continents. These systems centralize customer data, provide real-time pipelines and forecasting, and integrate with marketing automation, support, and billing solutions.

In 2026, CRM is increasingly intertwined with revenue operations (RevOps). Organizations integrate CRM with tools for subscription billing, customer success management, and product analytics to create an end-to-end view of the customer lifecycle. AI-enhanced forecasting, account scoring, and churn prediction allow revenue leaders in New York, Berlin, Paris, Toronto, and Singapore to allocate resources more effectively and tailor engagement strategies at scale. Those interested in the broader implications for go-to-market strategy can explore coverage of marketing and growth trends.

Human Capital, Employment, and Workforce Management

Human resources and employment management have been reshaped by SaaS platforms that handle everything from recruitment and onboarding to performance management and payroll. Solutions such as Workday, SAP SuccessFactors, BambooHR, and Gusto provide unified systems that support compliance across multiple jurisdictions, which is crucial for companies employing talent in the United States, United Kingdom, European Union, and Asia-Pacific simultaneously.

The rise of remote and hybrid work has further elevated the importance of SaaS-based HR and talent platforms. Performance management tools, learning management systems, and employee engagement platforms ensure that teams in Stockholm, Dublin, Seoul, and Auckland remain aligned and supported. Recruitment platforms and applicant tracking systems, integrated with global job boards and professional networks, have expanded talent pools while enabling data-driven hiring decisions. Readers monitoring the evolution of global job markets and skills can connect these developments with insights on employment and future-of-work trends.

Finance, Banking, and Regulated Industries

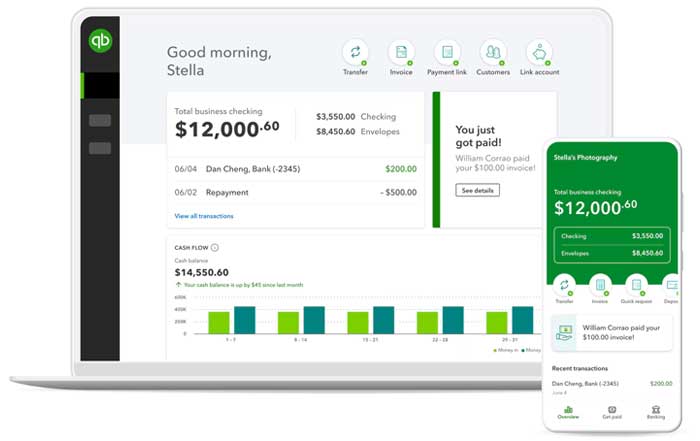

SaaS has become central to modern finance functions. Cloud-based accounting and ERP systems allow real-time consolidation, multi-currency support, and automated compliance reporting. Integrations with open banking APIs and digital payment gateways streamline receivables and payables, while analytics layers provide CFOs with scenario planning and forecasting tools that would once have required custom-built systems.

In banking and capital markets, regulated institutions have gradually embraced SaaS for non-core but mission-critical capabilities such as risk management, fraud detection, marketing automation, and customer onboarding. RegTech and SupTech platforms deliver automated compliance monitoring and reporting aligned with evolving regulatory frameworks in the United States, United Kingdom, European Union, and Asia. Institutions assess vendors rigorously on security, data residency, and auditability, but once qualified, SaaS solutions often outperform bespoke internal systems in both agility and total cost of ownership.

Marketing, Analytics, and Customer Insight

Marketing in 2026 is inseparable from SaaS-based analytics and automation. Platforms that manage email campaigns, advertising, social media, and customer data platforms (CDPs) provide marketers with unified views of engagement across channels. AI-driven segmentation and personalization help organizations in Los Angeles, London, Amsterdam, Copenhagen, and Hong Kong tailor experiences to regional preferences while maintaining consistent global brand narratives.

Analytics-focused SaaS tools, from product analytics to web and app measurement, have democratized data access. Business leaders no longer wait for quarterly reports; they monitor dashboards that update in near real time, tracking conversion rates, cohort performance, and customer lifetime value. This pervasive visibility into customer behavior and financial performance feeds directly into strategic planning and market entry decisions, aligning marketing, product, and finance around shared metrics.

Security, Compliance, and Trust in the SaaS Era

As organizations entrust critical data and processes to SaaS providers, security and compliance have become central components of vendor evaluation and architecture design. Leading providers now adhere to stringent global standards, including ISO 27001, SOC 2, and regional data protection regulations such as the EU's GDPR and evolving privacy frameworks in North America and Asia.

Zero-trust security architectures, multi-factor authentication, single sign-on, and fine-grained access controls are standard features. Identity and access management platforms, secure networking solutions, and cloud-native security services work in concert to protect data from unauthorized access and cyber threats. Many SaaS applications now incorporate behavioral analytics and anomaly detection to identify suspicious activity proactively.

Trust is also being reinforced through transparency. Providers increasingly publish security whitepapers, participate in bug bounty programs, and offer detailed audit logs and data processing addendums. Enterprises in heavily regulated sectors such as banking, healthcare, and public services now conduct rigorous due diligence and continuous monitoring, yet the maturity of leading SaaS vendors has made large-scale cloud adoption viable even for the most risk-sensitive institutions. Readers tracking how these developments intersect with broader technology risk and resilience can find additional perspective in coverage of technology strategy and infrastructure.

SaaS, AI, and Data-Driven Decision Making

The convergence of SaaS and AI has turned data into a practical, everyday asset for businesses of all sizes. Business intelligence platforms, predictive analytics tools, and AI-enhanced dashboards are increasingly delivered as SaaS, reducing the need for specialized infrastructure and in-house data engineering teams.

Organizations now integrate data from CRM, ERP, marketing, support, and product usage systems into centralized warehouses or lakehouses, often managed as cloud services. On top of these, SaaS analytics platforms provide self-service exploration, visualization, and modeling capabilities. Executives in New York, London, Frankfurt, Zurich, Singapore, and Tokyo can interrogate performance metrics, run what-if scenarios, and generate board-ready narratives directly from their browsers. Those interested in how these capabilities influence capital markets and asset allocation can connect this evolution to broader markets and investment analysis.

Crucially, AI within SaaS is moving beyond descriptive and predictive analytics toward prescriptive and generative capabilities. Systems propose actions-such as adjusting pricing, reallocating marketing spend, or revising inventory plans-and can, with human oversight, execute these changes automatically. This shift places a premium on governance frameworks, ethical AI policies, and data stewardship practices that ensure transparency and fairness in algorithmic decision-making.

SaaS, Sustainability, and Responsible Growth

Sustainability has become a board-level priority in Europe, North America, and increasingly across Asia-Pacific, Africa, and South America. SaaS platforms are now instrumental in tracking and managing environmental, social, and governance performance.

Specialized sustainability SaaS solutions consolidate data on energy consumption, emissions, supply chain performance, and regulatory compliance into unified dashboards. These tools help companies in Paris, Berlin, Oslo, Copenhagen, Toronto, and Wellington monitor progress toward net-zero commitments, prepare disclosures aligned with emerging global reporting standards, and identify opportunities for efficiency gains. For readers following the intersection of technology and sustainability, further analysis is available through coverage of sustainable business practices.

At the same time, major cloud and SaaS providers have committed to aggressive decarbonization targets, investing in renewable energy, efficient data center design, and carbon accounting transparency. Customers increasingly factor the environmental footprint of digital infrastructure into procurement decisions, pushing vendors toward greener operations. In this way, SaaS not only enables sustainability reporting but also becomes part of the solution to reducing the environmental impact of digital transformation itself.

Regional Leadership, Emerging Players, and Market Maturity

The United States remains the largest and most mature SaaS market, home to global leaders in CRM, productivity, cloud infrastructure, and AI platforms. The United Kingdom, Germany, France, the Netherlands, the Nordic countries, and Switzerland have developed strong ecosystems focused on compliance, industrial software, and sustainability-focused solutions.

In Asia, Japan, South Korea, Singapore, and increasingly India have become major centers of innovation, producing SaaS platforms tailored to regional financial regulations, logistics networks, and education systems. Australia and New Zealand have built vibrant SaaS communities with global reach, particularly in accounting, workforce management, and creative tools. In Latin America and Africa, local champions are emerging with deep understanding of regional payment systems, regulatory environments, and customer behavior, often expanding first across neighboring markets before entering North America or Europe.

For founders, this global landscape presents both opportunity and competition. Vertical SaaS-solutions tailored to specific industries such as healthcare, construction, manufacturing, or legal services-has become a fertile ground for new ventures. Founders who combine domain expertise with cloud-native design and AI capabilities are building defensible businesses that can scale internationally. Readers exploring founder journeys and startup ecosystems can connect these developments with insights on global founders and entrepreneurship.

Outlook: SaaS as the Strategic Platform for the Next Decade

Looking ahead from 2026, SaaS is positioned to remain the dominant model for delivering business software, but its character will continue to evolve. The next phase will likely be defined by deeper AI integration, greater interoperability, and more explicit alignment with sustainability and regulatory expectations.

AI copilots will become standard across most major SaaS categories, transforming how employees interact with systems-from natural language queries and automated workflows to intelligent assistance in drafting, analysis, and decision-making. Low-code and no-code capabilities will enable non-technical professionals to configure and extend SaaS platforms, reducing dependence on scarce developer resources and accelerating innovation at the edge of organizations.

Interoperability will be increasingly critical. Open APIs, shared data standards, and ecosystem partnerships will allow businesses to assemble best-of-breed solutions without creating data silos. Vendors that facilitate seamless integration across CRM, ERP, HR, finance, marketing, and analytics layers will enjoy a strategic advantage. At the same time, regulators in the European Union, United States, and Asia are paying closer attention to data portability, concentration of digital power, and AI governance, shaping the rules under which SaaS ecosystems operate.

For the global audience of upbizinfo.com, the central message is clear: SaaS is no longer a tactical IT procurement choice but a strategic lever that influences competitiveness, resilience, and long-term value creation. Whether one is a founder in Berlin, an investor in New York, a banking executive in London, a technology leader in Singapore, or a policymaker in Brussels, understanding how SaaS underpins AI, financial systems, employment models, sustainability strategies, and global trade is essential to navigating the next decade of economic and technological change.