The long-standing reliance on fossil fuels is gradually giving way to a renewable-driven future, reshaping markets, economies, and the very notion of energy security. The transition to renewable sources is not simply an environmental imperative—it has become a strategic economic and geopolitical necessity. From policy reforms in the European Union to technological breakthroughs in China, and from private-sector investments in the United States to new cross-border collaborations in Asia, the decarbonization journey is influencing trade, innovation, and employment on an unprecedented scale.

The urgency for transformation stems from the converging pressures of climate change, volatile oil markets, and advancing renewable technologies. According to projections from the International Energy Agency (IEA), renewables will account for more than half of global power generation by 2030, with solar and wind emerging as the most dominant contributors. This structural change is redefining capital flows, business models, and even the fiscal frameworks of nations traditionally dependent on hydrocarbon revenues.

To understand the complexity of this transformation, it is essential to analyze how governments, corporations, and innovators are aligning to accelerate this global shift, while also addressing the socio-economic challenges it brings. The discussion extends beyond technology—it encapsulates global cooperation, economic stability, and the reimagination of sustainable growth for the decades ahead.

Policy Drivers and International Cooperation

One of the strongest catalysts behind the renewable transition is the growing network of international agreements and national commitments. The Paris Agreement remains a cornerstone of global climate strategy, with over 190 signatories pledging to achieve net-zero emissions in the coming decades. Yet, as 2025 progresses, it is clear that words must translate into measurable action, supported by capital investment and policy enforcement.

In Europe, the European Green Deal has been pivotal, positioning the continent as a global leader in clean energy transition. By combining regulatory reforms with large-scale funding through the NextGenerationEU recovery plan, Europe has accelerated the adoption of wind, solar, and hydrogen technologies. The European Investment Bank (EIB) has also committed to phasing out fossil fuel project financing, channeling billions into clean infrastructure and energy efficiency programs.

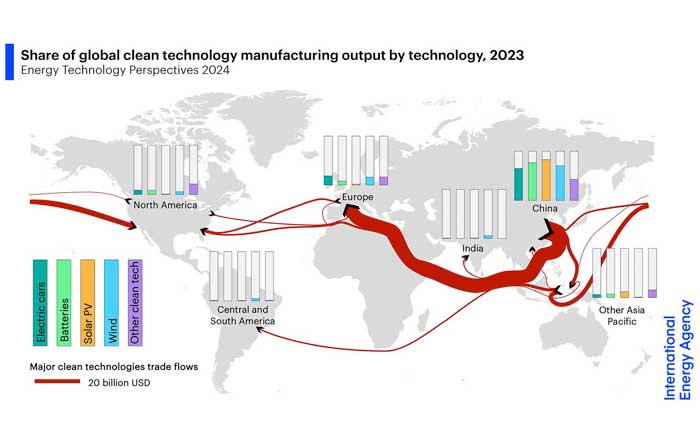

In the United States, the Inflation Reduction Act (IRA) has reshaped the domestic renewable energy market, offering tax credits and subsidies that have catalyzed private investment in solar manufacturing and battery production. This has created new competition with Asia, particularly with China, which continues to dominate global solar supply chains and electric vehicle battery production. The U.S. government’s drive toward domestic energy independence has led to a renaissance in localized clean technology manufacturing, fostering economic resilience while reducing import dependence.

Emerging economies are also taking bold steps. India’s National Solar Mission and Brazil’s wind energy expansion programs have demonstrated that developing nations can leverage renewables to boost economic growth while lowering emissions. In Africa, projects supported by the African Development Bank (AfDB) and international partners have opened new horizons for decentralized energy systems, particularly through solar mini-grids and mobile-enabled microfinancing models that bring power to off-grid communities.

For deeper insights into global business strategies shaping this transition, explore upbizinfo.com/world.html.

Technological Innovation and Market Dynamics

Technology remains the core enabler of the renewable energy revolution. Rapid advances in solar photovoltaics, offshore wind, green hydrogen, and grid-scale battery storage have transformed the economics of renewable power generation. Costs have plummeted—solar energy, for instance, is now the cheapest source of electricity in many parts of the world, thanks to large-scale production and continuous innovation.

Tesla, BYD, Vestas, Siemens Energy, and Enphase Energy are among the major companies driving these technological frontiers. Meanwhile, artificial intelligence is becoming integral to optimizing power grids and forecasting energy demand. AI-driven predictive maintenance and smart metering systems enhance efficiency, reduce downtime, and ensure a balanced integration of intermittent renewable sources into existing networks.

Hydrogen has emerged as a particularly transformative element of the renewable narrative. Known as the “fuel of the future,” green hydrogen—produced using renewable electricity—holds immense potential for decarbonizing heavy industries and long-haul transport. Projects such as NEOM Green Hydrogen Company in Saudi Arabia and HyDeal Ambition in Europe illustrate how large-scale hydrogen ecosystems can foster energy self-sufficiency and industrial competitiveness.

At the same time, digital transformation is redefining how markets operate. Blockchain-based energy trading platforms, for example, allow peer-to-peer energy transactions that decentralize control and increase transparency. As more startups and fintech innovators enter the energy space, traditional utility models are being disrupted, paving the way for smarter, more inclusive systems. Learn more about AI integration in the energy market at upbizinfo.com/ai.html.

The Role of Investment and Financing

Transitioning to renewable energy at a global scale requires unprecedented levels of capital mobilization. The International Renewable Energy Agency (IRENA) estimates that cumulative investment in renewable energy will need to surpass $130 trillion by 2050 to meet net-zero goals. This financial transformation is reshaping both private and public markets.

Institutional investors, sovereign wealth funds, and development banks are increasingly embedding environmental, social, and governance (ESG) principles into their portfolios. Major financial institutions such as BlackRock, Goldman Sachs, and HSBC have established green financing frameworks that prioritize low-carbon projects. Furthermore, the rise of green bonds and climate-focused exchange-traded funds (ETFs) has expanded capital access for renewable developers.

Governments are equally instrumental in de-risking investment through guarantees, subsidies, and public-private partnerships. In Asia, Singapore’s Green Plan 2030 provides a comprehensive financial roadmap that incentivizes corporations to invest in sustainable solutions. Similarly, Germany’s KfW Bank continues to support climate innovation through low-interest loans and venture capital initiatives aimed at renewable startups.

The intersection between finance and technology is particularly evident in the growing integration of blockchain for tracking carbon credits and ensuring transparent green certification. Platforms such as Energy Web and Powerledger demonstrate how digital tools can improve market accountability and facilitate cross-border renewable energy trading.

To explore more about investment opportunities in renewables, visit upbizinfo.com/investment.html.

Economic and Employment Transformation

The renewable energy transition is not only redefining capital markets—it is transforming labor markets as well. According to data from IRENA, renewable energy employment surpassed 13 million jobs globally in 2024, with solar photovoltaic installations accounting for the largest share. This rapid job creation highlights the sector’s potential to drive inclusive growth and reduce inequality, especially in developing economies.

Countries like Germany, Australia, and South Korea are investing in workforce retraining programs to ensure that displaced workers from fossil fuel industries can transition smoothly into renewable sectors. Initiatives such as Australia’s Clean Energy Skills Plan and Germany’s Energy Transition Alliance represent strong examples of how industrial evolution can be aligned with social responsibility.

In parallel, education systems are adapting to prepare future generations for green careers. Universities and technical institutions across Europe and North America are expanding degrees in sustainable engineering, renewable energy management, and environmental economics. This academic evolution ensures a continuous pipeline of skilled professionals capable of leading future innovation.

For more about global employment transitions, explore upbizinfo.com/employment.html.

Geopolitical Implications and Energy Independence

Energy has always been a powerful geopolitical instrument, influencing international relations and trade policy. As renewables rise, traditional energy dependencies are shifting, redefining global alliances and strategic priorities. The decline in fossil fuel demand threatens to destabilize economies heavily reliant on oil and gas exports, such as those in the Middle East and parts of Russia, compelling them to diversify rapidly into green technologies.

Conversely, nations rich in renewable resources—such as Chile’s solar deserts, Norway’s hydropower, and Morocco’s wind corridors—are becoming new players in the energy trade. These developments suggest a democratization of global energy, where access to sunlight, wind, and technological capability may outweigh geological luck.

However, this transformation also introduces new challenges, including competition over critical raw materials. The production of solar panels, batteries, and wind turbines depends heavily on minerals like lithium, cobalt, and rare earth elements—commodities concentrated in a few regions such as China, Chile, and the Democratic Republic of Congo. Ensuring ethical and sustainable supply chains for these materials will be essential to avoid replicating old geopolitical tensions in a new form.

For related analyses on international energy politics, visit upbizinfo.com/world.html.

🌍 Global Renewable Energy Timeline

Key Milestones in the Transition to Clean Power

2024

Job Creation Milestone

Renewable energy employment surpassed 13 million jobs globally, with solar PV leading the sector

💼

⚡

2025

Green Finance Surge

Global green bond issuance exceeded $2 trillion, mainstreaming sustainable investment instruments

2030 Target

Renewable Dominance

Renewables projected to account for over 50% of global power generation, led by solar and wind

🌞

🎯

2030 Goal

India's Capacity Target

India aims for 500 GW renewable capacity through government programs and international partnerships

2035 Vision

Quantum Innovation

Convergence of quantum computing and materials science may redefine renewable performance limits

🔬

🌐

2040 Projection

Renewable-Powered World

Global energy mix projected to be predominantly renewable with advanced storage and digital systems

2050 Mission

Net-Zero Achievement

Cumulative investment of $130 trillion needed to achieve global net-zero emissions targets

🎖️

50%+

Renewable Power (2030)

Regional Perspectives: A Global Mosaic of Renewable Progress

North America: Innovation Meets Industrial Renewal

In North America, the energy transformation has become both an industrial and political agenda. The United States, under renewed federal commitments to carbon neutrality, continues to expand its clean energy infrastructure through extensive funding from the Department of Energy (DOE) and private partnerships. States such as California, Texas, and New York have emerged as clean energy powerhouses, combining solar, wind, and energy storage technologies to balance grid reliability with sustainability. The rapid growth of electric vehicles, spearheaded by companies like Tesla and Rivian, has further strengthened domestic clean technology supply chains, stimulating job creation and technological exports.

Canada, with its vast hydropower resources and emerging offshore wind projects, is positioning itself as a leading exporter of clean electricity to both domestic and U.S. markets. The country’s focus on green hydrogen and renewable natural gas (RNG) initiatives underlines its long-term strategy to decarbonize industrial sectors and transportation. Meanwhile, in Mexico, solar farms in the Sonoran Desert and private-sector wind collaborations have drawn attention from global investors, though regulatory stability remains a concern for sustained progress.

Learn more about how business innovation is shaping energy transformation at upbizinfo.com/business.html.

Europe: Leading the Global Energy Transition

Europe remains the world’s most consistent driver of renewable adoption and regulatory leadership. The European Union’s Fit for 55 package aims to reduce net greenhouse gas emissions by 55% by 2030, solidifying Europe’s trajectory toward carbon neutrality by mid-century. Countries like Germany, Spain, and Denmark have demonstrated how coordinated national policies and regional collaboration can foster an integrated renewable energy ecosystem. Offshore wind capacity in the North Sea, for instance, is being expanded through multilateral projects involving Siemens Gamesa, Ørsted, and Vattenfall, creating a blueprint for transnational clean power sharing.

France and Sweden continue to diversify their low-carbon portfolios, investing not only in renewables but also in nuclear modernization as part of a balanced decarbonization approach. Meanwhile, Italy and Spain have accelerated solar installations, capitalizing on favorable climates and evolving EU funding frameworks to achieve grid parity. European leadership in environmental policy has also sparked global influence, inspiring carbon-pricing models and green financing standards across multiple continents.

Explore more about Europe’s economic leadership in sustainability at upbizinfo.com/sustainable.html.

Asia: From Rapid Growth to Responsible Energy

Asia’s role in the renewable revolution is defined by scale and speed. China remains the epicenter of global solar manufacturing, producing over 70% of the world’s photovoltaic modules. Its investment in offshore wind, smart grids, and electric vehicle production underscores its long-term ambition to dominate the global clean energy value chain. The China National Energy Administration (NEA) continues to push aggressive targets for renewables while phasing down coal, setting benchmarks that influence policy in neighboring countries.

India, driven by its ambitious 500 GW renewable capacity target by 2030, is reshaping its energy landscape through a combination of government programs and international partnerships. Initiatives like the International Solar Alliance (ISA)—co-founded by India and France—symbolize the country’s growing influence in clean diplomacy. Similarly, Japan, South Korea, and Singapore are investing heavily in hydrogen infrastructure, smart city energy management systems, and next-generation nuclear research to ensure diversified and resilient energy systems.

Southeast Asia’s progress, led by Thailand, Malaysia, and Indonesia, shows that distributed solar, floating photovoltaic systems, and geothermal projects can coexist with industrial expansion. By aligning regional development with environmental protection, Asia is proving that high growth and sustainability are not mutually exclusive.

Discover related insights about regional economies at upbizinfo.com/markets.html.

Africa: The Dawn of Decentralized Power

Africa’s renewable journey represents one of the most transformative shifts in its modern history. With abundant sunlight, wind corridors, and untapped hydropower, the continent holds immense potential to leapfrog into a renewable-powered future. The African Union’s Agenda 2063 and the Africa Renewable Energy Initiative (AREI) have accelerated collaboration across nations, fostering projects that deliver affordable and sustainable electricity to millions.

Kenya and Ethiopia have made substantial progress with geothermal power, while South Africa is expanding its renewable auction programs to attract global investors. In Morocco, the Noor Ouarzazate Solar Complex—one of the world’s largest concentrated solar power plants—has become a symbol of how innovation and policy alignment can drive regional self-sufficiency. Furthermore, mobile-based energy payment systems and microgrid installations across Nigeria, Ghana, and Tanzania are transforming access to power, supporting entrepreneurship, education, and healthcare.

Learn more about emerging markets driving sustainable innovation at upbizinfo.com/founders.html.

Latin America: Harnessing Nature’s Power

Latin America is rapidly gaining prominence in global renewable expansion due to its abundant natural resources. Brazil leads the region in wind and hydropower generation, while Chile has emerged as a hub for solar and green hydrogen exports. The Andes region offers some of the highest solar irradiance on the planet, positioning nations such as Peru and Bolivia as future leaders in clean electricity generation.

Investment interest is also growing in Argentina’s wind corridor and Colombia’s geothermal exploration, supported by multilateral funding and private equity participation. As the region diversifies away from fossil fuels, governments are introducing reforms to ensure transparent auctions, grid modernization, and stable return frameworks. This approach not only strengthens investor confidence but also positions Latin America as a major exporter of clean power to global markets seeking renewable imports.

For more about how investment flows are shaping global energy opportunities, visit upbizinfo.com/investment.html.

Energy Storage and Smart Grids: The Backbone of Renewables

The integration of renewable sources into national grids introduces complex challenges due to the intermittent nature of solar and wind power. To address this, innovations in energy storage and grid management have become indispensable. Battery energy storage systems (BESS) are now one of the fastest-growing segments in the clean energy sector, with major players such as CATL, LG Energy Solution, and Panasonic pushing new frontiers in lithium-ion and solid-state battery technology.

Smart grids equipped with digital sensors, AI-driven load forecasting, and cloud-based data analytics are revolutionizing energy distribution. They enable real-time monitoring, adaptive load balancing, and consumer participation through decentralized energy markets. Pilot programs in the Netherlands, Japan, and Singapore demonstrate how digital intelligence can stabilize power supply while enhancing overall efficiency.

Furthermore, advancements in long-duration energy storage—such as flow batteries and compressed air systems—promise to extend renewable reliability even further. This technological momentum is enabling countries to scale renewable integration faster than ever before, creating resilient and flexible systems capable of meeting global power demand sustainably.

Explore how technology and digital transformation are changing industries at upbizinfo.com/technology.html.

Private Sector Leadership and Corporate Sustainability

The private sector’s commitment to renewable adoption has become one of the strongest forces driving the transition. Corporations across industries are pledging to achieve 100% renewable operations through initiatives such as the RE100 coalition, which includes companies like Google, Apple, Microsoft, and IKEA. These organizations not only power their facilities with clean energy but also influence supply chains, pushing suppliers and partners toward similar commitments.

Financial institutions are also aligning with sustainability goals. Major asset managers and pension funds are adopting ESG investment criteria that prioritize companies with robust carbon-reduction plans. This shift has amplified accountability across corporate governance structures, making environmental performance a determinant of market value and investor confidence.

Furthermore, multinational corporations are partnering with governments to co-develop clean infrastructure. For example, Amazon Web Services and Shell have launched joint projects to enhance renewable-powered data centers, while automotive manufacturers like Volkswagen and Hyundai are expanding EV production facilities to reduce lifecycle emissions.

For readers interested in how sustainable business models drive long-term profitability, visit upbizinfo.com/business.html.

Challenges and Market Realities

Despite its progress, the global renewable transition faces formidable challenges. Supply chain bottlenecks, raw material constraints, and uneven regulatory enforcement remain persistent barriers. The global competition for lithium, cobalt, and nickel—essential components of battery technology—has created a new wave of geopolitical tension, particularly as countries strive to secure stable access to these resources.

Infrastructure limitations, especially in developing nations, also impede large-scale integration of renewables. Transmission grids often require modernization to handle variable power flows, and financing gaps persist in regions with limited credit access. Moreover, the intermittent nature of wind and solar energy demands advanced forecasting and energy balancing mechanisms that not all nations are equipped to deploy yet.

The financial burden of transition poses another complex issue. While developed economies have the resources to invest heavily in renewables, emerging nations often rely on external funding and climate aid, making progress uneven. Bridging this gap requires international cooperation, long-term financing strategies, and transparent governance to ensure that the benefits of the green transition are equitably shared.

The Future of Energy Markets: Integration, Decentralization, and Digitalization

The future of the global energy landscape is not merely about replacing fossil fuels with renewables—it is about transforming the very architecture of how energy is produced, distributed, and consumed. As countries progress through the energy transition, three structural shifts are emerging as the pillars of tomorrow’s power ecosystem: integration, decentralization, and digitalization.

Integration refers to the seamless blending of renewable sources into national and international power systems. This involves cross-border interconnections, regional energy sharing, and cooperative grid development to ensure stability and efficiency. The Nordic Power Market, for instance, has long been an example of effective energy integration, allowing Norway, Sweden, Finland, and Denmark to balance hydro, wind, and thermal resources in real time. The European Union is now expanding this concept across the continent through the Trans-European Energy Networks (TEN-E) initiative, creating one of the most interconnected electricity systems in the world.

Decentralization is another defining feature of the future energy landscape. With advances in battery storage, smart meters, and distributed generation, consumers are becoming “prosumers”—producing their own electricity while feeding excess power back into the grid. This democratization of energy empowers households and businesses to participate in the energy economy directly, enhancing resilience and reducing dependence on centralized utilities. Rural electrification projects in Africa and Asia exemplify how decentralized systems can deliver power to previously unreachable communities through microgrids and community solar hubs.

Digitalization, driven by Internet of Things (IoT) devices, blockchain, and artificial intelligence, is turning energy systems into intelligent ecosystems. Real-time analytics improve grid reliability, detect anomalies, and predict maintenance needs, reducing operational costs. Blockchain applications, in particular, are reshaping carbon credit trading and ensuring transparent renewable energy certification. Through these combined forces, energy systems are evolving into self-optimizing, self-balancing networks that can adapt to fluctuations in demand and supply dynamically.

For a deeper understanding of how digital transformation drives industrial evolution, explore upbizinfo.com/technology.html.

Emerging Trends in Renewable Energy Economics

The economics of renewable energy in 2025 have reached a tipping point. For the first time in history, solar and onshore wind are not only competitive with fossil fuels—they are often cheaper. The Lazard Levelized Cost of Energy (LCOE) report shows that renewable generation costs have dropped by over 80% for solar and 60% for wind over the past decade. This dramatic decline has unlocked unprecedented opportunities for investors and businesses to transition toward low-carbon portfolios without compromising profitability.

Another key trend is the rise of energy-as-a-service (EaaS) models. Corporations and municipalities are increasingly outsourcing their energy management to specialized service providers that handle everything from procurement and storage to performance optimization. This business model enhances operational efficiency and enables organizations to meet carbon reduction targets without major upfront capital investments.

The expansion of green hydrogen, bioenergy, and offshore wind also marks the next phase of renewable diversification. Hydrogen Europe, Air Liquide, and Plug Power are advancing commercial-scale hydrogen production, while countries such as Australia and Japan are building export-oriented hydrogen infrastructure. Bioenergy, meanwhile, is being reimagined through circular economy models that turn waste into fuel, offering an additional revenue stream for industries and municipalities committed to sustainability.

Learn more about how market forces are redefining investment opportunities at upbizinfo.com/markets.html.

Global Financing Architecture for a Renewable Future

Financing remains the linchpin of global energy transformation. As renewable adoption accelerates, new financing mechanisms are emerging to match the scale of ambition. Green bonds, sustainability-linked loans, and blended finance models have grown into mainstream instruments that align public and private capital toward clean energy objectives.

In 2025, green bond issuance has exceeded $2 trillion globally, with major issuers such as European Investment Bank (EIB), World Bank, and Asian Development Bank (ADB) setting the standard for transparency and impact reporting. Private investors are following suit, with ESG funds capturing record inflows as sustainability becomes a decisive factor in long-term asset performance.

The integration of fintech and renewable energy financing is another significant development. Blockchain-based platforms are enabling fractional ownership of renewable projects, allowing individuals and small investors to participate in energy infrastructure financing. This democratization of investment enhances inclusivity and diversifies funding sources across the global economy.

Meanwhile, global cooperation is deepening through initiatives like the Green Climate Fund (GCF) and the Just Energy Transition Partnerships (JETP), which mobilize billions in concessional finance for developing countries. By linking climate objectives with financial innovation, these programs ensure that no economy is left behind in the transition to clean power.

For more financial insights and investment frameworks, visit upbizinfo.com/banking.html.

Social and Economic Equity in the Transition

A critical dimension of the global renewable transition lies in ensuring fairness and inclusivity. Energy poverty still affects over 700 million people worldwide, primarily in sub-Saharan Africa and parts of South Asia. As nations shift toward renewables, addressing the affordability and accessibility of clean energy becomes a central challenge.

The concept of a Just Energy Transition emphasizes the need to protect workers and communities historically dependent on fossil fuels. Governments are introducing social safety nets, retraining programs, and regional development funds to mitigate the social costs of industrial transformation. South Africa’s Just Energy Transition Partnership, supported by the European Union, United Kingdom, and United States, exemplifies a model for equitable decarbonization that combines financial support with local capacity building.

At the consumer level, decentralized renewable solutions offer new opportunities for empowerment. From rooftop solar installations in suburban homes to community wind cooperatives in rural towns, citizens are gaining direct control over their energy sources. This participatory approach not only improves affordability but also fosters local ownership and responsibility toward sustainable consumption.

Discover more about how global employment and social equity are being redefined at upbizinfo.com/employment.html.

Energy Security and Global Stability

Renewable energy is gradually transforming the foundation of global security. Traditional energy geopolitics, dominated by oil and gas dependencies, are giving way to a new order shaped by technological capability and mineral access. This shift has profound implications for international relations, economic alliances, and supply chain dynamics.

Energy independence is increasingly achievable through domestic renewable generation, reducing exposure to volatile fossil fuel markets. Countries that once relied heavily on imports are now investing in self-sufficient systems, making their economies more resilient to global shocks. The European response to the 2020s energy crises demonstrated how diversification into renewables can strengthen both economic stability and political autonomy.

However, new vulnerabilities are emerging around the sourcing of critical minerals. Lithium, nickel, and cobalt are now strategic commodities, leading to the formation of new trade blocs and cooperative frameworks such as the Minerals Security Partnership (MSP). These initiatives aim to ensure sustainable extraction practices and supply diversification to prevent monopolistic control.

As global power dynamics evolve, the nations that lead in renewable innovation, manufacturing, and deployment will hold significant strategic advantages. The competition is not only for energy dominance but for technological and economic leadership in the next era of industrial progress.

Learn more about geopolitical shifts and their economic implications at upbizinfo.com/world.html.

The Corporate Race Toward Net-Zero

In the corporate world, achieving net-zero emissions has become synonymous with long-term viability. Companies across every sector are restructuring their operations, supply chains, and investment strategies to align with climate goals. This shift extends beyond compliance—it has become a competitive differentiator influencing brand reputation, investor trust, and consumer loyalty.

Microsoft, for example, has committed to becoming carbon negative by 2030 and removing its historical emissions by 2050. Apple continues to achieve progress toward powering its entire value chain with renewable energy, while Google operates on 24/7 carbon-free energy in several global data centers. Industrial giants like General Electric, ABB, and Siemens Energy are redefining energy infrastructure through advanced turbine designs, digital twins, and hybrid renewable systems that increase output while minimizing waste.

The momentum is also visible in the financial sector. JPMorgan Chase and Citigroup are investing billions in clean energy portfolios, while insurers and asset managers are integrating climate risk into underwriting and investment decisions. The convergence of financial, technological, and environmental goals marks a historic reorientation of corporate strategy—one in which sustainability is no longer an afterthought but a driver of profitability and resilience.

For updates on corporate sustainability and innovation trends, visit upbizinfo.com/news.html.

Toward a Renewable Future: Innovation, Policy, and Human Resolve

The energy transition is no longer a theoretical aspiration; it is an active global movement defined by technological progress, policy ambition, and societal determination. Yet its success depends not only on innovation and investment but also on maintaining momentum in the face of complex challenges. As nations move toward 2050, the interplay between policy frameworks, market mechanisms, and human creativity will determine how effectively the world achieves a clean, resilient, and inclusive energy future.

In 2025, the global economy is shaped by competing priorities: energy security, economic growth, and environmental responsibility. Governments that once relied on fossil fuels for revenue are now crafting long-term strategies to diversify their economies and attract renewable investments. The evolution of Saudi Arabia’s Vision 2030, for instance, exemplifies how oil-dependent economies can shift toward renewables and technology-driven growth. Similarly, Norway’s Sovereign Wealth Fund, one of the largest in the world, has divested from coal and high-emission sectors while reinvesting in clean technology companies, signaling how financial prudence aligns with sustainability.

The world’s major economic blocs—the United States, European Union, and China—are setting the pace for innovation and market transformation. Through coordinated research and development programs, cross-border supply chain integration, and clean energy diplomacy, they are establishing new standards for global cooperation. Their influence extends beyond national borders, shaping international trade policies, energy pricing structures, and environmental governance.

For readers seeking comprehensive analyses of global business transformations, visit upbizinfo.com/economy.html.

AI and Predictive Energy Management

Artificial intelligence has become indispensable in optimizing renewable systems. AI algorithms are now used to forecast weather patterns, predict solar and wind generation, and manage grid stability in real time. Machine learning systems developed by companies such as Google DeepMind and IBM Research have demonstrated that AI-driven energy forecasting can improve grid efficiency by more than 20%. This is a major breakthrough, particularly in countries where renewable integration is reaching saturation levels and grid balancing is critical.

The use of digital twins—virtual models of physical assets—allows energy operators to simulate performance, identify inefficiencies, and reduce downtime across solar farms and wind parks. Combined with IoT sensors, these systems provide continuous feedback loops that enhance asset longevity and operational profitability.

In the financial sector, AI is improving investment analytics by identifying high-performing renewable projects and predicting market trends. This capability enables investors to allocate resources efficiently and mitigate risks associated with fluctuating energy prices. As technology and finance continue to converge, the synergy between AI and energy markets will define the next phase of clean energy optimization.

Explore how artificial intelligence is driving technological transformation at upbizinfo.com/ai.html.

The Role of Developing Economies

Developing economies occupy a crucial position in the global transition. They represent the fastest-growing demand for energy and, consequently, the most significant opportunity for renewable expansion. Yet they also face challenges related to infrastructure, financing, and governance.

In Southeast Asia, for example, the combination of rapid urbanization and industrialization has fueled massive energy demand. To address this, countries such as Vietnam, Indonesia, and the Philippines are pursuing hybrid strategies that combine solar, wind, and natural gas as transitional sources. These strategies reflect pragmatic pathways that balance environmental goals with economic realities.

In Africa, where energy access remains a barrier to development, decentralized renewable systems are revolutionizing livelihoods. Solar home systems and pay-as-you-go models supported by organizations like M-KOPA and d.light have illuminated millions of homes while creating employment and entrepreneurship opportunities. These examples highlight how renewable energy is not merely a climate solution but also a catalyst for inclusive growth.

The Latin American experience further underscores how renewables can serve as both an economic and diplomatic asset. Chile’s hydrogen diplomacy and Brazil’s ethanol expertise have become instruments of soft power, enabling these countries to participate actively in shaping global sustainability dialogues.

Learn more about global business opportunities in emerging regions at upbizinfo.com/world.html.

Consumer Behavior and Corporate Responsibility

The renewable transition is as much a cultural and behavioral evolution as it is a technological one. Consumers across continents are becoming active participants in the energy ecosystem, demanding transparency, sustainability, and ethical practices from businesses. This shift is influencing corporate decision-making at every level—from supply chain sourcing to product design and marketing.

The rise of carbon-conscious consumers has compelled corporations to embrace sustainability reporting frameworks such as CDP (Carbon Disclosure Project) and Science Based Targets Initiative (SBTi). These standards not only enhance accountability but also attract environmentally aware investors. Meanwhile, renewable-powered brands like Patagonia, IKEA, and Unilever are proving that green business models can achieve strong profitability while maintaining environmental stewardship.

Digital platforms are also empowering consumers to make more informed energy choices. Smart home technologies, such as Google Nest and Samsung SmartThings, enable users to optimize their energy consumption in real time. The proliferation of electric vehicles further reinforces this behavioral shift, turning individual consumers into direct contributors to decarbonization.

To understand more about the intersection of business strategy and consumer sustainability, visit upbizinfo.com/marketing.html.

The Race for Technological Leadership

The next decade will be defined by competition for technological supremacy in renewable innovation. Nations and corporations alike are racing to lead in solar cell efficiency, offshore wind capacity, and next-generation energy storage. China, the United States, Japan, and Germany are investing heavily in R&D to produce more efficient and recyclable renewable systems.

The rise of perovskite solar technology marks a milestone in solar efficiency, potentially doubling the energy yield of conventional photovoltaic panels. Floating offshore wind farms, pioneered by Equinor and Mitsubishi Heavy Industries, are expanding renewable capacity into deeper waters, previously inaccessible to traditional turbines. At the same time, advancements in battery chemistry, such as solid-state and sodium-ion technologies, promise to reduce dependence on scarce minerals like cobalt and lithium.

Moreover, the fusion of quantum computing and materials science could unlock even greater efficiencies in the future. Quantum algorithms can model molecular interactions with unparalleled precision, accelerating the discovery of new energy materials. This convergence of computation, science, and engineering may redefine the limits of renewable performance by 2035.

Explore how innovation drives market competitiveness at upbizinfo.com/technology.html.

A New Era of Global Collaboration

The global energy transition is inspiring unprecedented collaboration across borders. Multilateral organizations such as the International Renewable Energy Agency (IRENA), World Economic Forum (WEF), and United Nations Development Programme (UNDP) are uniting governments, private enterprises, and civil society under shared sustainability objectives. These networks foster knowledge exchange, align regulatory frameworks, and facilitate investment in regions that would otherwise remain underserved.

Regional partnerships are also gaining momentum. The European Union’s Green Hydrogen Alliance, ASEAN Renewable Energy Framework, and Africa Clean Energy Corridor each represent collective approaches to achieving large-scale energy transformation. Similarly, global corporations are participating in initiatives such as the UN Global Compact and Race to Zero, aligning their operations with planetary goals.

Beyond policy and investment, this era of collaboration reflects a deeper cultural shift—a recognition that the fight against climate change transcends borders. The global energy transition is, therefore, a shared responsibility that demands mutual trust, innovation, and long-term vision.

To explore more about international cooperation and investment, visit upbizinfo.com/investment.html.

The Road Ahead: Building a Sustainable Energy Civilization

The energy transition represents more than a technological revolution—it is the foundation of a new economic civilization. By 2040, the global energy mix is projected to be predominantly renewable, supported by advanced storage, digital control systems, and circular economy principles. This evolution will create new industries, redefine national competitiveness, and foster a sense of shared purpose in addressing humanity’s greatest challenge: sustainability.

However, the journey ahead demands perseverance. Policymakers must continue to design adaptive regulations that encourage innovation while maintaining stability. Businesses must embed sustainability in their core strategies, not as a marketing tool but as an existential imperative. Investors must think long-term, recognizing that the greatest returns will come from projects that balance profitability with environmental integrity. And citizens—through their choices, awareness, and advocacy—must remain active participants in shaping a cleaner world.

The energy markets of tomorrow will be more interconnected, intelligent, and inclusive than ever before. The convergence of renewables, artificial intelligence, and human collaboration is laying the groundwork for an era where clean energy powers not only economies but also possibilities.

For more insights on global business transformation and sustainable economic growth, visit upbizinfo.com.

Conclusion

As the global transition to renewable energy accelerates, it redefines power not just in an electrical sense but in a geopolitical, economic, and societal context. The era of fossil dominance is gradually yielding to one driven by innovation, inclusivity, and sustainability. What began as a climate necessity has evolved into an economic opportunity and a moral obligation.

In this decisive decade, the path forward lies in collaboration, vision, and technological courage. The nations, organizations, and individuals that embrace renewable energy not merely as a solution but as a philosophy of progress will lead the world into a new age of prosperity—powered by clean energy, guided by responsibility, and inspired by the boundless potential of human ingenuity.