The 10 Largest Technology Companies in 2026: Power, AI, and the Future of Global Business

Why Scale in Technology Matters More Than Ever

By early 2026, technology has become the defining infrastructure of the global economy, shaping everything from financial systems and employment patterns to geopolitics and sustainable development. For decision makers and readers of UpBizInfo, whose interests span artificial intelligence, banking, business strategy, crypto, macroeconomics, employment, founders' journeys, investment, marketing, global markets, sustainability, and frontier technologies, understanding which technology firms dominate the landscape is no longer a curiosity; it is a prerequisite for informed strategic planning.

The largest technology companies-measured primarily by market capitalization and complemented by revenue scale, technological influence, and strategic direction-now function as operating systems for the world economy. Their platforms underpin cloud computing, AI infrastructure, payments, communication, digital advertising, logistics, and even the design of future semiconductor architectures. Investors track them as bellwethers of innovation and risk; entrepreneurs treat them as both partners and competitors; policy makers view them as quasi-regulators whose product decisions can reconfigure entire industries overnight.

In 2026, the composition of this upper echelon reveals several structural shifts. Semiconductor and AI infrastructure companies, once seen as specialized suppliers, now sit alongside or even above traditional software and consumer-tech leaders in market value and strategic centrality. The rise of generative AI, large-scale model training, and data-center buildouts has reweighted the technology stack, making chips, energy, and cloud capacity as critical as user interfaces and mobile apps. At the same time, regulators in the United States, Europe, and Asia are more assertive, and geopolitical competition around digital sovereignty, export controls, and data localization is intensifying.

For UpBizInfo, which is committed to delivering credible, forward-looking analysis across technology, business, economy, and markets, this article provides a holistic examination of the ten largest technology firms in 2026, focusing on how they achieved their scale, what differentiates their capabilities, and how their strategies are likely to shape the next decade of global business.

1. Nvidia: Commanding the AI Compute Frontier

By 2026, Nvidia stands at the center of the AI revolution as the preeminent supplier of high-performance GPUs and AI accelerators. Its market capitalization, which crossed the multi-trillion-dollar threshold in 2025, reflects not only extraordinary revenue growth from data-center products but also investor belief that Nvidia's hardware and software stack has become foundational to modern AI.

Nvidia's rise from graphics specialist to AI infrastructure giant was driven by its early investment in parallel computing and the CUDA platform, which created a de facto standard for GPU programming. This ecosystem lock-in, supported by sophisticated libraries, developer tools, and reference architectures, made it difficult for enterprises and hyperscalers to switch to alternatives without incurring high migration costs. As generative AI models expanded in size and complexity, demand for Nvidia's cutting-edge chips, networking solutions, and DGX systems surged across the United States, Europe, and Asia, with data-center operators from Microsoft, Amazon, Google, and leading Chinese cloud providers competing for scarce supply.

However, Nvidia's dominance is not risk-free. Export controls affecting advanced chips shipped to China, the need to diversify manufacturing partners such as TSMC, and growing competition from custom silicon efforts at Google, Amazon, and Meta, as well as from emerging AI chip startups, create strategic pressure. Regulatory scrutiny over concentration of compute power and concerns about AI's energy footprint further complicate long-term planning. Yet, as organizations worldwide-from financial institutions in London and New York to research labs in Germany, Japan, and South Korea-continue to scale AI workloads, Nvidia's combination of hardware innovation, software ecosystems, and deep partnerships positions it as the central infrastructure provider for the AI age. Learn more about how AI is reshaping business models and investment priorities through UpBizInfo's AI coverage.

2. Microsoft: Enterprise Cloud, AI Platforms, and Global Reach

Microsoft has evolved into a full-spectrum cloud and AI powerhouse, using its Azure platform, productivity suite, and enterprise relationships to anchor its position among the world's largest technology companies. Its strategic alliance and investment in OpenAI, alongside its own research in large language models and copilots, transformed Microsoft from a software vendor into a core provider of AI-augmented workflows for enterprises, governments, and small businesses.

In 2026, Microsoft's differentiation lies in the breadth and integration of its offerings. Azure provides scalable infrastructure and AI services; Microsoft 365 embeds generative AI and automation into everyday productivity tools; GitHub and Visual Studio extend AI support to developers; and its security portfolio underpins critical infrastructure across North America, Europe, and Asia-Pacific. This integrated approach creates durable switching costs and recurring revenue streams, reinforced by long-term enterprise contracts and regulatory-grade compliance capabilities. For decision makers assessing digital transformation strategies, Microsoft's model illustrates how to combine cloud, AI, productivity, and security into a coherent value proposition. Explore how such integrated strategies influence corporate performance in UpBizInfo's business insights.

Yet, Microsoft also faces complex challenges. Competition from Amazon Web Services and Google Cloud in infrastructure, evolving open-source AI ecosystems, and global regulatory scrutiny regarding bundling practices and market dominance all require careful navigation. The company must balance aggressive AI deployment with responsible AI practices, data protection, and adherence to emerging frameworks such as the EU's AI Act, which are tracked closely by institutions like the European Commission. Sustaining its leadership will depend on Microsoft's ability to keep innovating in AI while maintaining trust among regulators, enterprises, and end users.

3. Apple: Premium Ecosystems and On-Device Intelligence

Apple remains a cornerstone of the global technology landscape, with its tightly integrated ecosystem of hardware, software, and services reaching hundreds of millions of users in the United States, Europe, China, Japan, and beyond. While iPhone sales still account for a substantial share of revenue, Apple's growth increasingly comes from high-margin services such as the App Store, Apple Music, iCloud, Apple TV+, and Apple Pay, as well as wearables and accessories.

In 2026, Apple's strategic narrative is defined by its emphasis on privacy-preserving, on-device AI and seamless user experiences. Custom silicon, including the M-series and A-series chips, enables efficient local processing of AI workloads, from camera enhancements and real-time translation to personalized recommendations and health tracking. This approach positions Apple as a counterweight to cloud-centric AI models, particularly in regions where data protection and digital rights are strongly enforced, such as the European Union under the GDPR framework. For consumers and businesses alike, Apple's controlled ecosystem offers a blend of security, performance, and brand trust that few rivals can match.

However, Apple must confront slowing growth in mature smartphone markets, intense regulatory scrutiny of the App Store's fee structure and competitive practices, and the need to create new product categories that resonate with consumers beyond early adopters. Its forays into mixed reality, spatial computing, and potential health-related devices will be closely watched by investors and analysts. For UpBizInfo readers tracking lifestyle, consumer behavior, and premium market positioning, Apple's strategy offers a rich case study, complemented by perspectives available in our lifestyle and technology sections.

4. Amazon: From E-Commerce Giant to AI-Powered Infrastructure and Logistics

Amazon continues to operate as a dual-engine technology company, combining its global e-commerce and logistics capabilities with the high-margin, high-impact Amazon Web Services (AWS) cloud platform. AWS remains one of the largest and most profitable cloud providers in the world, serving startups, enterprises, and public-sector institutions across North America, Europe, Asia, and emerging markets. At the same time, Amazon's retail operations, advertising business, and subscription services such as Prime form a powerful flywheel of data, logistics scale, and customer loyalty.

By 2026, Amazon's strategy is increasingly centered on AI at every layer. In logistics, AI-driven optimization, robotics, and predictive analytics enhance warehouse efficiency and last-mile delivery, supported by automation technologies similar to those studied by the MIT Center for Transportation & Logistics. In cloud, AWS provides specialized AI chips, managed model services, and domain-specific solutions for industries such as finance, healthcare, and manufacturing. For retailers and brands, Amazon's advertising and recommendation systems leverage AI to drive conversion and monetization.

Nevertheless, Amazon faces persistent antitrust scrutiny in the United States and Europe, questions about marketplace fairness for third-party sellers, and growing competition from regional champions in markets such as India, Southeast Asia, and Latin America. It must also manage complex labor dynamics and regulatory expectations around working conditions and automation, which intersect with broader employment trends that UpBizInfo tracks in its employment and jobs coverage. The extent to which Amazon can continue balancing aggressive expansion, regulatory compliance, and stakeholder trust will shape its long-term trajectory.

5. Alphabet (Google): Search, Advertising, and Reinvention Through AI

Alphabet, the parent company of Google, remains one of the world's most influential technology firms, anchored by its dominance in search, digital advertising, and key consumer services such as YouTube, Google Maps, Android, and Gmail. These platforms collectively reach billions of users across continents, giving Alphabet unparalleled insight into global behavior, content consumption, and commercial intent.

In 2026, Alphabet's central strategic challenge and opportunity is the integration of generative AI and large language models into its core businesses. Search is being reimagined with conversational interfaces and AI-generated summaries, while productivity tools in Google Workspace incorporate AI assistance for writing, analysis, and collaboration. Google Cloud continues to compete with Azure and AWS, emphasizing data analytics, AI services, and open-source partnerships. Alphabet's R&D extends into longer-horizon bets, including quantum computing, autonomous driving via Waymo, and health initiatives inspired by advances documented by institutions such as the National Institutes of Health.

Alphabet must, however, manage intensifying regulatory and legal pressure. Antitrust cases in the United States and Europe, concerns over online content moderation, and privacy regulations such as the ePrivacy Directive and emerging AI rules in the EU all place constraints on its operating freedom. Moreover, the shift toward AI-generated content challenges traditional advertising models and raises questions about attribution, publisher economics, and misinformation. For UpBizInfo readers following global regulatory trends, digital advertising, and AI business models, Alphabet's evolution provides a lens into how legacy digital platforms adapt-or fail to adapt-to structural change.

6. Meta Platforms: Social Graphs, AI Agents, and Immersive Experiences

Meta Platforms, the company behind Facebook, Instagram, WhatsApp, and related services, has transformed itself from a pure-play social media company into a broader platform focused on AI-enhanced communication and immersive experiences. Its vast user base across North America, Europe, Latin America, and parts of Asia gives Meta a unique position in digital social infrastructure, with messaging and social feeds remaining central to daily life for billions.

By 2026, Meta's investments in generative AI, creator tools, and augmented and virtual reality have begun to reshape its value proposition. AI-driven content recommendation, synthetic media creation, and digital assistants are increasingly integrated into its platforms, enabling new forms of engagement, commerce, and advertising. Its VR and AR hardware, while not yet fully mainstream, has carved out meaningful niches in gaming, collaboration, and training, echoing broader trends in human-computer interaction studied by organizations such as the IEEE.

Meta's path forward is constrained by reputational challenges and regulatory oversight. Concerns around data privacy, mental health impacts, political polarization, and the spread of misinformation have led to closer monitoring by authorities in the United States, United Kingdom, European Union, and other jurisdictions. Meta must demonstrate that its AI systems and immersive environments can be governed responsibly, with robust safeguards and transparency. Its experience underscores a broader theme highly relevant to UpBizInfo readers: technological scale without social trust can become a liability, especially in markets where regulators and civil society expect stronger accountability from digital platforms.

7. Broadcom: The Quiet Backbone of Connected Infrastructure

Broadcom is less visible to consumers than many of the other giants, but it plays a critical role as a leading provider of semiconductors and infrastructure software that power data centers, networking equipment, broadband, storage, and wireless communication. Through a combination of organic innovation and major acquisitions, Broadcom has built a diversified portfolio spanning chips, enterprise software, and security solutions used by telecom operators, hyperscalers, and large enterprises worldwide.

In 2026, Broadcom's strategic importance is amplified by the global buildout of AI data centers, 5G and emerging 6G networks, and cloud-scale storage systems. Its networking chips and optical interconnect components are essential for high-bandwidth, low-latency communication between servers and accelerators, enabling the performance levels required by large language models and real-time analytics. For institutional investors and corporate strategists, Broadcom exemplifies how infrastructure suppliers can achieve outsized influence by sitting at the intersection of multiple high-growth demand curves.

Nevertheless, Broadcom must navigate cyclical demand in semiconductors, integration risks from large software acquisitions, and regulatory scrutiny over consolidation in critical infrastructure markets. Its success depends on sustaining R&D investment, maintaining strong relationships with equipment makers and telecom providers, and responding to evolving standards and security requirements. These dynamics intersect with broader market and investment themes regularly covered by UpBizInfo in its investment and markets reporting.

8. TSMC: Manufacturing the World's Most Advanced Chips

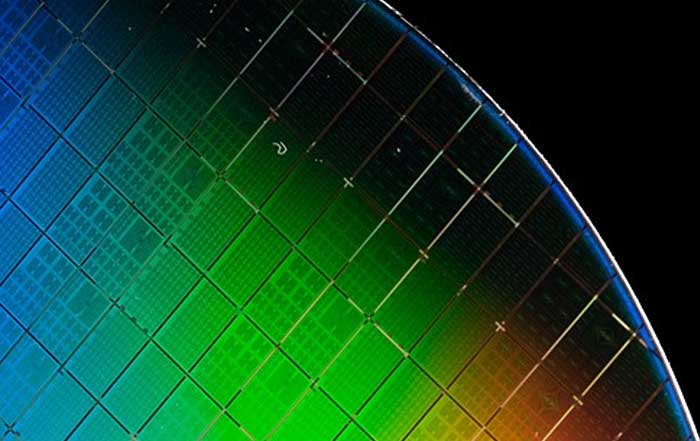

Taiwan Semiconductor Manufacturing Company (TSMC) remains the world's leading semiconductor foundry, fabricating chips designed by companies such as Apple, Nvidia, AMD, and Qualcomm on the most advanced process nodes. Its manufacturing capabilities at 3nm and below, including sophisticated packaging technologies, are essential for delivering the performance and energy efficiency required by AI, smartphones, servers, and edge devices.

By 2026, TSMC's strategic role is even more pronounced as AI accelerators, high-bandwidth memory, and advanced logic chips drive unprecedented demand for cutting-edge manufacturing. The complexity and capital intensity of modern fabs-documented by industry groups such as SEMI-create extraordinarily high barriers to entry, limiting competition to a small number of global players. TSMC's reputation for reliability, yield, and confidentiality has made it a trusted partner for leading technology companies across the United States, Europe, and Asia.

Yet, TSMC operates within a highly sensitive geopolitical context. Tensions in the Taiwan Strait, export controls on advanced equipment to China, and national efforts in the United States, Europe, and Japan to build domestic semiconductor capacity all shape its risk profile. Initiatives like the U.S. CHIPS and Science Act, explained by sources such as the U.S. Department of Commerce, aim to rebalance supply chains, but replicating TSMC's capabilities is a long-term endeavor. For UpBizInfo's globally oriented readership, TSMC illustrates how technology, geopolitics, and industrial policy converge in ways that directly affect markets, employment, and innovation trajectories.

9. Oracle: Enterprise Databases Evolving into Cloud and AI Platforms

Oracle has long been synonymous with enterprise databases, but in 2026 it presents itself as a full-stack cloud and AI platform provider. Its Oracle Cloud Infrastructure (OCI), autonomous database solutions, and integrated application suites serve large enterprises and public-sector organizations across North America, Europe, Asia, and the Middle East, particularly in industries with stringent regulatory and performance requirements such as banking, healthcare, and government.

Oracle's competitive advantage lies in its deep installed base and long-standing relationships with CIOs and IT departments, which enable cross-selling of cloud, analytics, and AI capabilities. Its focus on performance-intensive workloads, secure data management, and hybrid cloud architectures positions it as an attractive option for organizations that cannot or will not fully migrate to public cloud hyperscalers. For example, financial institutions governed by frameworks monitored by bodies like the Bank for International Settlements often require the kind of robust, auditable infrastructure that Oracle emphasizes.

However, Oracle's growth ambitions must contend with strong competition from AWS, Azure, and Google Cloud, as well as from open-source databases and analytics platforms. Convincing customers to modernize legacy deployments and adopt new Oracle cloud services requires clear economic and operational benefits. For UpBizInfo readers in banking, enterprise IT, and regulated sectors, Oracle's trajectory offers insight into how legacy technology providers can reposition themselves in an AI- and cloud-centric world, a theme mirrored in our banking and technology analyses.

10. ASML: The Lithography Gatekeeper of Advanced Semiconductors

ASML occupies a uniquely pivotal role as the sole supplier of extreme ultraviolet (EUV) lithography machines needed to manufacture the most advanced semiconductor nodes. These highly complex systems, which combine optics, lasers, and precision engineering at the limits of physics, enable chipmakers like TSMC, Samsung, and Intel to continue following the trajectory of Moore's Law for high-performance logic devices.

By 2026, ASML's tools are indispensable for producing the chips that power AI accelerators, advanced smartphones, high-performance computing, and next-generation networking equipment. The company's deep R&D investments, long development cycles, and tight collaboration with customers and component suppliers create formidable barriers to entry, making ASML a strategic chokepoint in the global semiconductor ecosystem. Its importance has been highlighted in policy debates and export-control regimes involving the Netherlands, the United States, and China, often covered by global media such as the Financial Times.

ASML faces challenges related to supply-chain complexity, long lead times, and geopolitical restrictions on where its most advanced tools can be sold. Nonetheless, as long as demand for cutting-edge chips continues to grow, ASML's role as an enabler of technological progress remains secure. For UpBizInfo's audience, ASML exemplifies the concept of "critical infrastructure within critical infrastructure," illustrating how specialized industrial capabilities can underpin entire layers of digital innovation.

Cross-Cutting Themes: AI, Capital, Regulation, and Sustainability

Taken together, these ten companies reveal several structural themes that matter deeply to UpBizInfo readers across regions from North America and Europe to Asia, Africa, and South America.

First, AI infrastructure has become the central battleground for value creation. Control over compute, data, and models-whether through GPUs, cloud platforms, or tightly integrated ecosystems-now shapes competitive advantage in sectors as diverse as finance, healthcare, manufacturing, and media. This shift is reshaping investment priorities, as documented by organizations such as the OECD in their analyses of digitalization and productivity, and is mirrored in UpBizInfo's dedicated AI and investment coverage.

Second, ecosystems and platforms increasingly determine who wins and who merely survives. Companies like Apple, Microsoft, Amazon, Alphabet, and Meta rely on tightly integrated product suites, developer communities, and data feedback loops that make it difficult for competitors to dislodge them. Semiconductor and infrastructure firms such as Nvidia, Broadcom, TSMC, and ASML, while operating in more specialized domains, similarly build ecosystems of partners and standards that amplify their influence.

Third, regulatory and geopolitical forces are no longer peripheral to technology strategy; they are central. Antitrust actions in the United States, digital market regulations in the European Union, data localization laws in countries such as India and China, and industrial policies around semiconductors and AI shape where and how these companies can operate. Institutions like the World Economic Forum and IMF increasingly emphasize the macroeconomic and societal implications of digital concentration, themes that UpBizInfo follows closely in its world and economy reporting.

Fourth, sustainability and responsible innovation are moving from optional narratives to core strategic imperatives. The energy demands of AI data centers, the carbon footprint of semiconductor manufacturing, and the social impacts of automation and digital platforms are under scrutiny by regulators, investors, and civil society. Frameworks such as the UN's Sustainable Development Goals, outlined by the United Nations, influence how capital is allocated and how corporate performance is evaluated. UpBizInfo's sustainable business content explores how leading companies are integrating environmental, social, and governance considerations into their strategies.

What This Means for the UpBizInfo Audience

For founders, executives, investors, and professionals who rely on UpBizInfo as a trusted guide to global business and technology trends, the trajectories of these ten companies offer both signals and lessons. They highlight where capital, talent, and infrastructure are concentrating; which capabilities are becoming non-negotiable for competitiveness; and how regulatory and societal expectations are evolving across regions from the United States and United Kingdom to Germany, Singapore, South Korea, and Brazil.

Entrepreneurs and founders can study how these giants build moats through ecosystems, data, and specialized hardware, while also identifying niches where agility, domain expertise, or regulatory alignment can create room for innovation. Corporate leaders can benchmark their own AI, cloud, and digital strategies against the integrated approaches of Microsoft, Amazon, and Alphabet, or learn from Apple's and Meta's attempts to blend hardware, software, and experience design. Investors can better assess the durability of business models and the risks embedded in high valuations, especially in sectors exposed to geopolitical tension or regulatory change, all of which are themes we examine in our markets and news sections.

Ultimately, these ten companies are not just technology leaders; they are architects of the emerging economic order. Their decisions will influence employment patterns, capital flows, digital rights, and sustainability outcomes across continents. UpBizInfo remains committed to tracking their moves, decoding their strategies, and connecting the dots for readers who need not only information, but insight they can act on in a world where technology and business are inseparable.